CANNABIS TAX AND ACCOUNTING

SCHEDULE ONE CONTROLLED SUBSTANCE

At the Federal level, non-hemp cannabis (marijuana) is currently classified as a Schedule I Controlled Substance, meaning marijuana and any products derived from marijuana are considered federally illegal. From an accounting and taxation perspective, this increases the complexity and risk of a business operating within the industry. Some of the many challenges this creates for cannabis business owners include complicated tax reporting requirements, “phantom” taxable income resulting in prohibitive tax liabilities, difficulty obtaining banking, and record-keeping obstacles due to cash-centric operations.

The Calyx team can help business owners navigate this challenging landscape and offer creative solutions to mitigate risk, increase compliance, and reduce tax liability.

HEMP VS MARIJUANA

With the passage of the 2018 Farm Bill, hemp flower and the production of flower-derived CBD products is no longer illegal.

Historically, “Industrial Hemp” was grown for fiber, seeds, oil, et cetera. However, for decades, hemp had been criminalized along with all cannabis products, despite lacking the psychoactive molecule THC. The 2018 Farm Bill differentiated between hemp and other cannabis plants, defining hemp as a cannabis plant with a THC concentration of not more than 0.3 percent by dry weight. Products derived from plants meeting these qualifications are now legal for interstate and international commerce.

Although many of the challenges discussed above have been lessened due to the differentiation of hemp from other cannabis products, operators within the industry still face strict regulations and compliance requirements. It’s vital to stay informed and to tread carefully to ensure your operations remain compliant and protected.

IRC § 280E

Section 280E of the Internal Revenue Code forbids businesses from deducting otherwise ordinary business expenses from gross income associated with the “trafficking” of Schedule I or II substances, as defined by the Controlled Substances Act.

More simply, this means that non-hemp cannabis businesses are unable to deduct their overhead expenses when calculating their taxable income. Only the cost of goods sold (COGS) can be deducted on the tax return. As such, businesses are faced with the “phantom income” problem, as they are forced to report taxable income in excess of their actual net earnings. Without strategic tax planning, the results can be devastating: effective tax rates can climb as high as 90%, and tax obligations can far exceed earnings and cash flow.

IRC § 471(c)

UPDATE: 01/07/2022

On January 7th, 2022, Alternative Therapies Group, Inc., a cannabis grower, filed a petition with the United States Tax Court in response to a Notice of Deficiency issued by the IRS. In the petition, ATG argues that the IRS erroneously disallowed their COGS deduction. Among other items, ATG argues that the IRS’s administrative practice of denying cannabis growers the ability to report COGS under Section 471(c) is “unreasonable…arbitrary… capricious… an abuse of the Commissioner’s discretion… not in accordance with Section 471(c)…” and is “…invalid under the Administrative Procedures Act.”

A number of tax attorneys and CPAs, including Calyx, agree with these accusations. Therefore, this area of cannabis tax law remains gray and uncertain. The Calyx team can help your business understand the impacts and risks of a variety of tax strategies, and ensure proper implementation of those strategies in order to maximize tax savings while minimizing risk exposure.

UPDATE: 01/05/2021

The IRS has published final regulations, which upheld the proposed regulations discussed below. Despite this unfavorable guidance, there are many professionals in the industry that question the validity of the regulations. Taxpayers may continue to use 471(c) to their advantage, however they’ll need to disclose their position on Form 8275-R and should be prepared to defend their position in court.

UPDATE: 7/30/2020

The IRS has issued proposed regulations for TCJA’s simplified accounting rules for small businesses, which include guidance on IRC § 471(c). The proposed regulations clarify that “ a taxpayer is not permitted to recover a cost that it otherwise would be neither permitted to recover nor deduct for Federal income tax purposes solely by reason of it being an inventory cost in the taxpayer’s AFS inventory method.” The regulations are not yet final; however, the outlook is bleak for cannabis businesses that were hoping to rely upon 471(c) to lessen the impact of IRC § 280E.

Section 471(c) was introduced into the Internal Revenue Code with the passage of the Tax Cuts and Jobs Act (TCJA). The code section exempts small businesses – those generating average annual gross receipts of $26 million or less – from the general rule for valuing inventory and, thus, cost of goods sold. A qualifying business can instead elect to conform to their internal accounting procedures as the basis for valuing inventories on their tax return.

As a result, cannabis businesses generating less than $26 million in revenue have the opportunity to defensibly shift costs otherwise disallowed through IRC § 280E into inventory, eventually transforming those non-deductible costs into deductible costs of goods sold.

IRC § 471(c) has the potential to offer significant tax savings opportunities to some cannabis businesses. However, it is not without risk. In January of 2021 the IRS released final regulation concluding that cannabis businesses are not allowed to use 471(c) to avoid taking otherwise disallowed expenses under 280E.

PROTECTIVE CLAIM FOR REFUND

Generally, taxpayers have a three-year window after filing their tax return to amend the return and file a claim for refund. This window gives taxpayers the flexibility to alter their original filings should they discover a mistake or omission, or if the preparation did not properly adhere to tax law and regulation.

A protective claim for refund allows for an extension of the three-year window if the taxpayer’s right to a refund is contingent upon future events. In the uncertain and ever-changing regulatory landscape of the cannabis industry, these protective claims can be extremely valuable. For example, should IRC § 280E be found unconstitutional, these claims would protect a taxpayer’s right to dig up old tax returns that would otherwise be “untouchable”, recalculate their taxable income and tax liability with the inclusion of previously non-deductible operating expenses, and recover those long lost tax dollars.

Protective claims have great potential but, to be useful, they must be timely filed and accurately prepared. Protective claims must be filed prior to the expiration of the taxpayer’s original statute of limitations – the three-year window mentioned above. So, don’t wait to explore the topic with your professional adviser. Contact the Calyx team to learn more.

Calyx CPA

Cannabis & Psychedelic Services Accounting Specialists

Calyx empowers entrepreneurs to build thriving businesses through accurate accounting and expert tax & accounting services by our licensed professionals.

541-816-4483

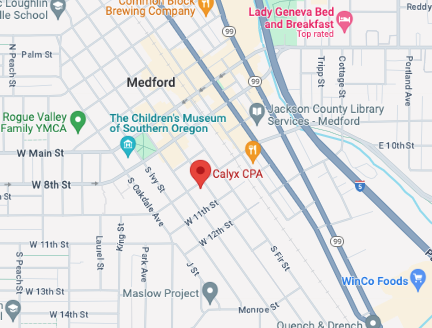

LOCATION ON MAP