Taxation Challenges in the Psychedelic Industries

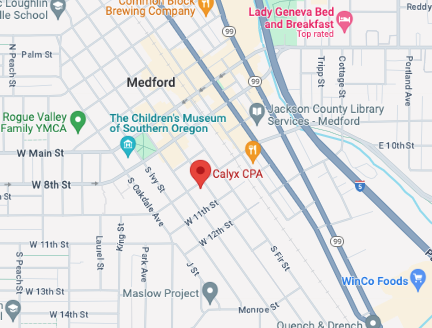

At the recent PsyCon Convention in Las Vegas, Justin Botillier of Calyx CPA based in Medford, Oregon, delivered a critical presentation addressing the intersection of taxation challenges within the cannabis and psychedelics industries. With deep expertise in cannabis taxation, Justin offered insights that are particularly relevant to both sectors, especially regarding IRS Section 280E.

Understanding IRS Section 280E and Its Broad Implications

The core of Justin’s presentation centered on IRS Section 280E. Initially implemented during the war on drugs in the early 1980s, Section 280E prohibits businesses involved with Schedule I or II controlled substances from deducting typical business expenses, except for the Cost of Goods Sold (COGS). Justin detailed how this section affects the psychedelics and cannabis businesses, creating significant financial hurdles due to the inability to deduct ordinary business expenses.

Insights for the Psychedelics Industry

While he put much focus on cannabis, Justin effectively bridged the conversation to include the psychedelics industry, which faces similar challenges and uncertainties regarding taxation and regulation. As the psychedelics sector continues to evolve, understanding the application of tax laws like 280E becomes crucial for business owners and investors within this space.

Strategic Tax Planning for Cannabis and Psychedelics

Bifurcation Strategy

Justin outlined a bifurcation strategy recommended by other professionals working in the psychedelics space to mitigate the tax burden of 280E. By splitting operations into two entities — one for plant-touching activities and another for non-plant-touching activities — businesses can optimize their tax filings.

Single Entity Strategy

For businesses that prefer a unified operational model, Justin discussed the benefits of a single-entity strategy, emphasizing rigorous accounting practices to allocate costs properly and maximize allowable deductions excluded by 280E. This approach requires a solid understanding of IRC Section 471c, which he explained in detail, demonstrating how careful inventory costing can shield a business from excessive tax liabilities.

IRC Section 471c: A Tool for Compliance and Optimization

Explaining the nuances of IRC Section 471c, Justin highlighted how this section allows for greater flexibility in accounting for inventory costs, thereby increasing deductible COGS. This is vital for both cannabis and psychedelic businesses seeking to navigate the limitations imposed by 280E effectively.

Anticipating Future Legal and Regulatory Shifts

Justin speculated on potential shifts in drug policy and legal frameworks that could impact the application of 280E to both cannabis and psychedelic businesses. He discussed possible rescheduling efforts and new regulatory developments, suggesting that changes in the legal landscape could mitigate some of the current challenges faced under 280E, beyond just rescheduling cannabis.

Expert Guidance for Navigating Complex Tax Landscapes

Concluding his presentation at PsyCon, Justin Botillier emphasized the importance of engaging with tax professionals who specialize in cannabis and, increasingly, in psychedelics. As the regulatory environments evolve, his insights into effective tax planning provide a roadmap for businesses to navigate these complex fields while maintaining compliance and optimizing financial outcomes.

Justin warns that beyond concerns about the ramifications of IRS audits, companies operating in “trafficking” businesses need to be extremely careful about whom they choose to file tax returns. More often than not, it is the accountant who will mire their clients in tax debt rather than the IRS.

ContactUs

Simply fill out the form and we will be in touch to answer any of your queries,

And feel free to check out our blog & video Section for more info.